Introduction

The preceding two decades have seen an enormous expansion of the role of commercial companies in the space domain. A series of policy decisions from the 1990s onward in the United States and other nations opened the door to the creation of numerous companies, many of which view governments as only a portion of their total business base. The decline in launch costs and application of new design and manufacturing approaches have lowered the barriers to entry for new commercial players. And several years of extraordinary capital inflow to space companies have created more competition and diversification in commercial space applications.

As of 2023, commercial satellites make up most of the active satellites in orbit. This is not only a dramatic change from the early decades of the space age, in which space activities were limited to only a few major government powers, but even from just ten years prior. In 2013, there were about 1,000 active satellites in orbit, approximately 20 percent of which were U.S. commercial, 20 percent were international commercial, and 60 percent were government (UCS, 2013). At the beginning of 2023, there were about 6,700 active satellites in orbit, approximately 60 percent of which are U.S. commercial, 20 percent are international commercial, and 20 percent are government. The number of government satellites increased two-fold from 2013 to 2023, but that growth was dwarfed by the increase on the commercial side, where international commercial satellites sextupled, and U.S. commercial satellites increased by a factor of 20 (UCS, 2023).

While there are uniquely governmental space capabilities, commercial firms are offering new and intriguing models for particular missions. For example, for electro-optical imagery, commercial providers have focused on achieving excellent temporal resolution (rapid revisit rates) to be complementary to traditional systems that focus on achieving high spatial resolution (small pixel sizes). To realize this capability, companies are deploying large numbers of small or midsized satellites, spanning the spectrum of space capabilities. Planet, for example, deployed a 150-satellite constellation in 2018 with the goal of being able to take an image of the entire Earth every day (Henry, 2020). Companies such as Capella Space have developed commercially owned synthetic aperture radar satellites, which can take imagery of the Earth through different atmospheric conditions during the day and at night (Werner, 2020). HawkEye360 and Aurora Insight are two examples of companies that offer satellite-based radiofrequency collection services (Vedda and Koller, 2020). Commercial capabilities also exist or are developing in space-based weather, hyperspectral imagery collection, ground stations, and space situational awareness, among other areas. Of course, the largest segment of the commercial space market remains communications, but even there the business models are rapidly evolving.

These space services are valuable to commercial players but also for national security applications, which speaks to the dual-use nature of space technology. Satellite communications can help air traffic controllers manage planes in crowded airspace and can help military forces send messages. Satellite imagery can help farmers identify pests among their livestock and can help policymakers track the movements of an adversary’s forces. Space-based infrared collection can detect forest fires but also artillery and missile launches. Given the dual-use nature of space technology, commercial space developments will play an important role in military operations and plans, and governments will need consider how to use commercial space developments for defense applications and where to draw the limits of such use.

The Appeal of Commercial Space for Military Applications

Time and Money

Defense acquisition is a time-intensive and expensive process. As The Aerospace Corporation (2019) has previously reported, “Under the current approach, it can take more than 10 years to develop, build, and launch highly complex space systems.” A primary advantage of using commercial space capabilities and services for national security applications is that doing so can save time and money. To the extent that commercial space capabilities and services exist that can satisfy defense needs, buying those capabilities or licensing those services would likely be a much more efficient use of resources than developing them independently. The U.S. Department of Defense buys commercially available products and services for many of its needs. It buys items such as computers and passenger cars from commercial companies. It also pays for services, such as potable water, electricity, and telephone services from commercial providers. Another example are iPads, which the U.S. military buys plenty of. Imagine how much more difficult it would be for the U.S. defense department to hire a contractor to develop iPads than to simply buy iPads that exist.

To the extent that commercial space capabilities and services exist that can satisfy defense needs, buying those capabilities or licensing those services would likely be a much more efficient use of resources than developing them independently.

– Dr. Jamie M. Morin

Accessibility

Another advantage of commercial satellite capabilities and services is that the data can be shared. Electro-optical imagery, synthetic aperture radar collection, radiofrequency mapping, and space situational awareness companies, among others, all collect data, either on the Earth or on the space environment. For some governments, it can be easier to disseminate commercial imagery or other data than information from government systems, whose capabilities may be sensitive. This dissemination can be powerful in certain circumstances. Increasingly, commercially available satellite imagery is being used for intelligence relating to military activity, and is creating new dynamics in global transparency by potentially being more credible to global audiences than information from government-controlled systems.

The Use of Commercial Space by Defense Agencies

New Models for Acquisition

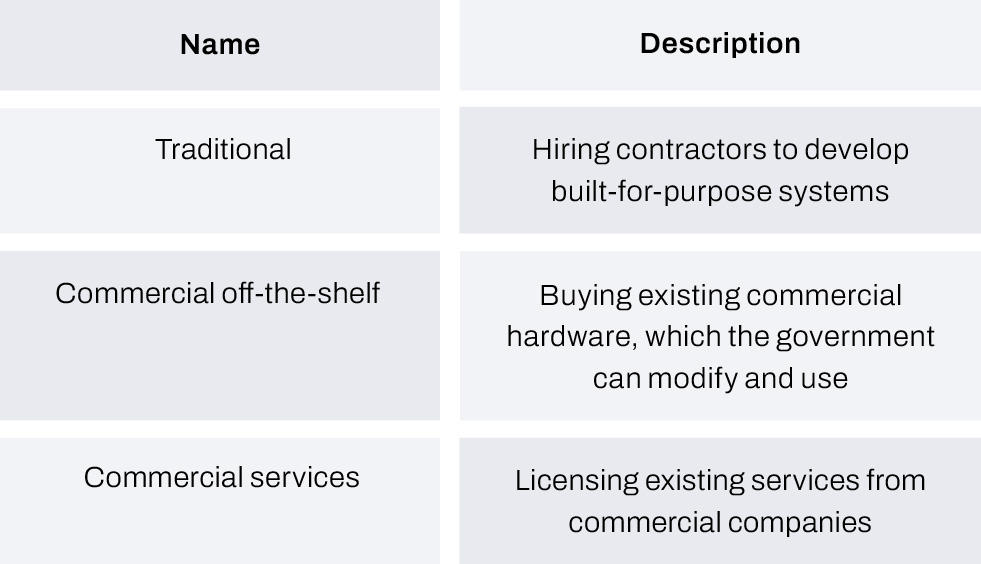

In December 2020, the Center for Space Policy & Strategy released a paper arguing that U.S. defense and intelligence agencies should employ non-traditional approaches for defense acquisition to leverage commercial space capabilities and services to a greater extent (Morin and Wilson, 2020). The traditional model is the U.S. government hiring a contractor to build specific capabilities designed to meet predetermined requirements. This is where the defense department spends most of its money. A second approach would be the defense and intelligence agencies buying space capabilities as they are, similar to how the department of defense buys passenger cars, personal computers, or iPads. A third approach would be the defense and intelligence agencies licensing services from capabilities they do not own, similar to their use of email clients and search engines.

These alternative approaches do include tradeoffs. Perhaps most significantly, they offer less control to the defense and intelligence agencies over the system itself. In the second approach, they own the capability, which can be ruggedized or adapted as needed, but they did not design it. In the third approach, they have even less control because they do not own the capability, just the service that the capability is providing. Despite these tradeoffs, the advantages are significant enough that, in many cases, space leadership should be willing to accept more risk. A primary challenge, at least in the United States, for buying commercially available products and services is that the U.S. defense acquisition process is designed for the traditional acquisition model. The government establishes requirements and custom capabilities built afterward can meet those requirements precisely. Buying commercially available products or services may mean not entirely addressing all of the requirements. But it may still be worthwhile to buy something that meets 80 percent of the requirements with 10 percent of the cost, for example, or meets some percentage of the requirements immediately.

Hybrid options that combine the different models to meet different parts of the need could cumulatively meet the necessary requirements while still saving money and time. In a mission area in which the government is willing to use commercial systems, it could procure commercial services, buy commercial assets, and still employ traditional acquisition to address needs unmet by what is available commercially. As commercial services expand and mature, governments will have more options for relying primarily on commercial capabilities with traditional acquisition filling niche gaps. Even for mission areas in which the government does not want to relinquish control to commercial providers, it could procure commercial assets and services to complement its main custom-built systems.

These hybrid options do not require exotic contracting approaches. However, getting them right may require redirecting acquisition organizations to focus on buying existing capabilities rather than developing them from scratch, and also encouraging flexibility in the requirements process. A famous tale of defense requirements becoming overly burdensome is the U.S. Army’s list of requirements for fruitcakes in the 1980s. As reported in the Washington Post, the Army had an 18-page list of military specifications for the holiday fruitcake. Senator Sam Nunn read the recipe on the Senate floor, noting that if DOD goes “to such lengths for fruit cakes…you can just imagine what the standards and specifications would be even for the most basic weapons system” (Weisskopf, 1985). In this case, the U.S. government responded, eventually getting rid of military specifications, which had the effect of creating more flexibility in requirements and standards for many items. Today, governments are considering further adjusting their acquisition organizations and processes to respond to the surge of commercial space providers.

As commercial services expand and mature, governments will have more options for relying primarily on commercial capabilities with traditional acquisition filling niche gaps.

– Dr. Jamie M. Morin

International Use of Commercial Space Capabilities

It is not just the United States that is using commercial space capabilities. Other countries are weighing options for using commercial space capabilities to meet government needs and build their domestic space industries for many reasons, including giving them options to use their own companies for commercial services and capabilities. South Korea and Singapore are two examples of countries that are focusing on commercial space development, including for military applications. The South Korean company Hanwha is building small surveillance satellites, which would have civilian and military applications, including monitoring North Korea (Kim, 2021). Singapore has procured foreign commercial electro-optical imagery for its Ministry of Defense (Conversation with Singapore officials, October 2022). More broadly, countries widely are investing more attention on their industrial policy for space.

Limits on the Use of Commercial Space for National Security

Relationship to Kinetic Operations

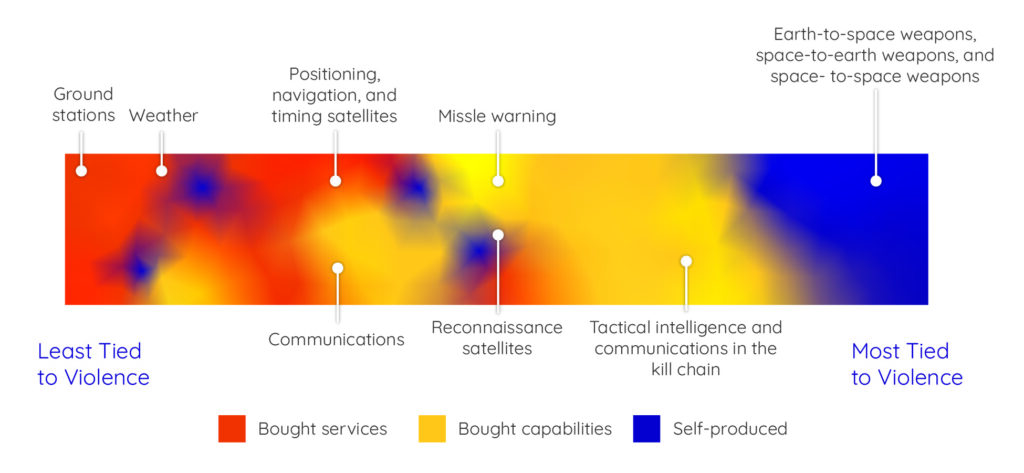

Commercial space capabilities may not be appropriate for every national security mission. A clear example may be capabilities closely tied to kinetic effect. If, for instance, countries sought one or more forms of space weapons capabilities (e.g., weapons from ground-to-space, space-to-space, or space-to-ground), the third capability acquisition model (services) would be extremely problematic, and the applicability of the second model (commercial off-the-shelf) would also be limited. Such capabilities may not be appropriate for commercial for three primary reasons:

- Capabilities tied to kinetic operations should warrant serious reflection and debate. One of the primary advantages, as noted, of buying commercial products or services is that a government can speedily procure them rather than having to wade through a long requirements or acquisition process. However, a weighty decision such as employing space weapons should not be made hastily, and the more traditional processes lend themselves to more oversight and discussion, which seems appropriate in this case.

- As noted, buying commercially available capabilities or services brings with it a certain level of risk; for capabilities directly tied to kinetic operations, the appetite for risk should be much lower. While governments may buy simpler weapons systems like firearms from commercial providers, more complex weapons capabilities are much more likely to be custom-made to reflect precisely what the government wants.

- Most space capabilities closely tied to kinetic operations would likely not be dual use; therefore, it is hard to imagine that the commercial sector would ever develop such capabilities for commercial markets. The use of commercial space capabilities for defense applications makes sense because those same capabilities can be used for commercial and defense purposes. Space weapons would not fall into that category; therefore, a commercial provider would not likely develop them unless to meet specific requirements from one or more governments. The Outer Space Treaty gives states responsibility for authorizing space activity, so commercial space capabilities tied to the use of violence would likely be viewed as under the control of the licensing state.

Figure 1 diagrams the spectrum of options for acquiring military space capabilities, showing which capabilities would be appropriately developed under more traditional models (blue) versus the second model of acquiring commercial capabilities (yellow) and the third model of acquiring services from commercially owned capabilities (orange). Moving left to right, the space capabilities shift from the innocuous (e.g., ground stations) to force enhancement (e.g., tactical intelligence and communications in the kill chain) to direct force application capabilities most closely tied to the use of violence (e.g., space weapons). The figure gradually shifts from orange to yellow to blue (least control with acquisition approach three to most control with acquisition approach one), but the three colors are interspersed throughout because the acquisition model for any specific capability will depend not just on whether it is tied to violence. It will also depend on the options for that capability or service from commercial companies, which will often raise capital and invest based on an ability to serve a market that extends beyond government purchasers.

Commercial Cooperation

Governments that want to leverage commercial space capabilities for national defense purposes should also be prepared to communicate with potential vendors about how their systems may be used, so that they can address reputational, liability, and risk concerns that commercial space companies may have. Some commercial companies may be uncomfortable with their use of systems in connection with kinetic operations, such as the use of their systems for targeting as part of an offensive operation. Others may worry that raising their public profile could result in malicious activity. Governments with domestic commercial space capabilities may have more options and greater trust in working with commercial companies than governments that rely on foreign commercial space systems. The conflict in Ukraine, for example, has shown that commercial space systems may be threatened or even targets for attack, just like other commercial assets in land, air, and maritime domains have been attacked in wars past (Dickey, 2022). Companies may determine that certain uses of their systems impose an unacceptable level of risk, though it is not clear that commercial companies can depend on their own decisions resulting in their assets being seen as non-combatant. Companies and governments should discuss concerns and options in the event a crisis were to arise

Conclusion

The recent deluge of commercial space capability presents tremendous opportunity to support military strategy, plans, operations; however, there are important questions that governments will need to grapple with if they want to leverage these systems for national security purposes. Governments will need to consider the acquisition models that they want to employ for using commercial systems, the types of missions that might be most appropriate for commercial capabilities or services, and the discussions and partnerships they need to have with commercial actors. Given the ascent of commercial space, both quantitative and qualitative, governments should focus on these questions in the near-term as well as on options for developing their own commercial space industry. While commercial space capabilities are not a complete replacement for sovereign national capabilities, nor for government-to-government partnerships, they do offer an important leverage opportunity for governments (both major space players and new entrants) seeking to advance their national security purposes.

References

Dickey, R. (2022) ‘Commercial Normentum: Security Challenges, Commercial Actors, and Norms of Behavior,’ The Aerospace Corporation Center for Space Policy and Strategy, 23August.

Available at: https://csps.aerospace.org/sites/default/files/2022-08/Dickey_CommercialNormentum_20220819.pdf

Henry, C. (2020) ‘SpaceX becomes operator of world’s largest commercial satellite constellation with Starlink launch,’ Space News, 6 January.

Available at: https://spacenews.com/spacex-becomes-operator-of-worlds-largest-commercial-satellite-constellation-with-starlink-launch/

Kim, B. (2021) ‘With restrictions lifted, South Korea launches $13B space power scheme,’ Defense News, 6 September.

Available at: https://www.defensenews.com/space/2021/09/06/with-restrictions-lifted-south-korea-launches-13b-space-power-scheme/

Morin J. and Wilson, R. S. (2020) ‘Leveraging Commercial Space for National Security,’The Aerospace Corporation, November.

Project Thor Team, (2019) ‘Outpacing the Threat With an Agile Defense Space Enterprise,’The Aerospace Corporation, September.

Union of Concerned Scientists, Satellite Database, Data as of April 2013.

Union of Concerned Scientists, Satellite Database, Data as of May 2023.

Vedda, J. A. and Koller, J. (2020) ‘Commercial Radio Frequency Collections from Space,’The Aerospace Corporation, March.

Weisskopf, M. (1985) ‘Fine Print for U.S. Fruitcakes,’ The Washington Post, 24 December.

Available at: https://www.washingtonpost.com/archive/politics/1985/12/24/fine-print-for-us-fruitcakes/94943d50-72d1-4384-9b27-a6c9f864f370/.

Werner, D. (2020) ‘PredaSAR to send 48 satellites into initial radar constellation,’ SpaceNews, 18 June. Available at: https://spacenews.com/predasar-48-satellites/.